Perfect, thanks Alex.

Ya, looks like we need to wire transfer some base funds to our Stripe account and then set this up. Our bank account does not clearly have the option to send wires so I’ve contacted them. After that I’ll get building this out, thanks!

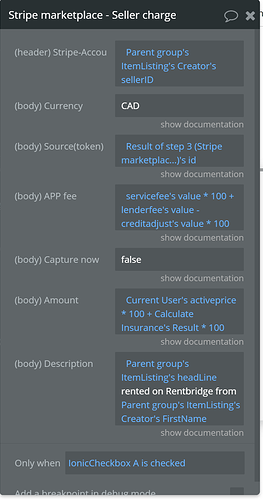

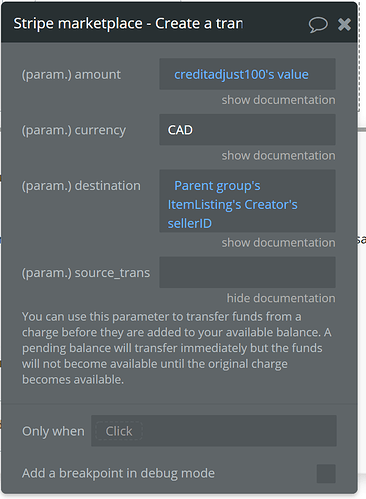

Question on the transfer workflow:

What are my options to type into source.trans? The description isn’t clear as to what I can type, just what it does.

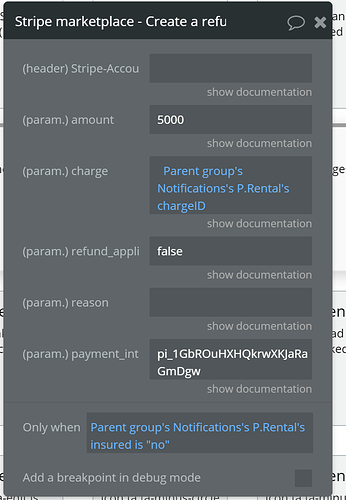

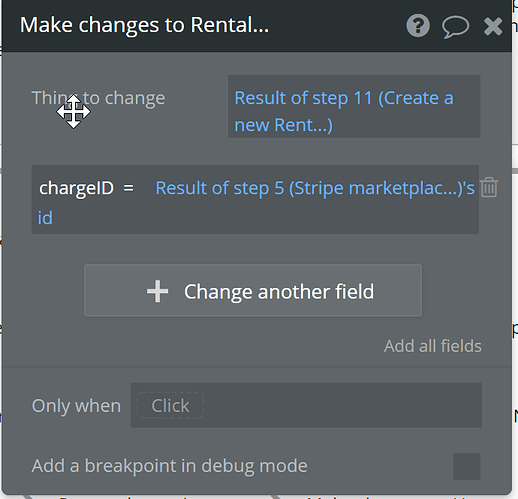

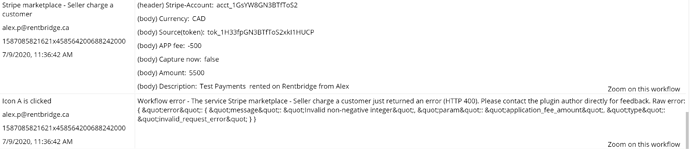

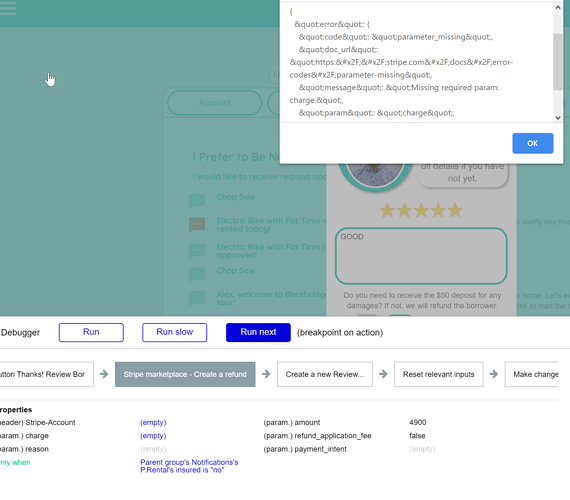

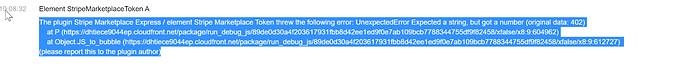

Also, I was testing it out and got this result when going to accept a charge that was made:

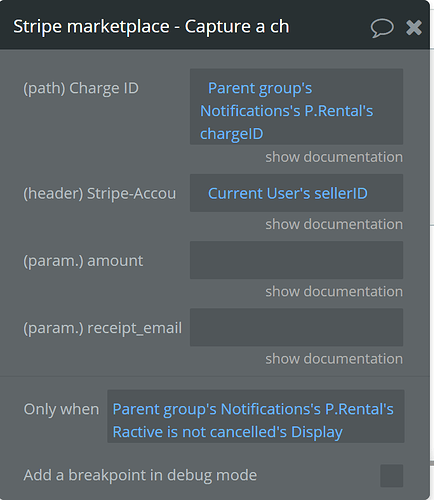

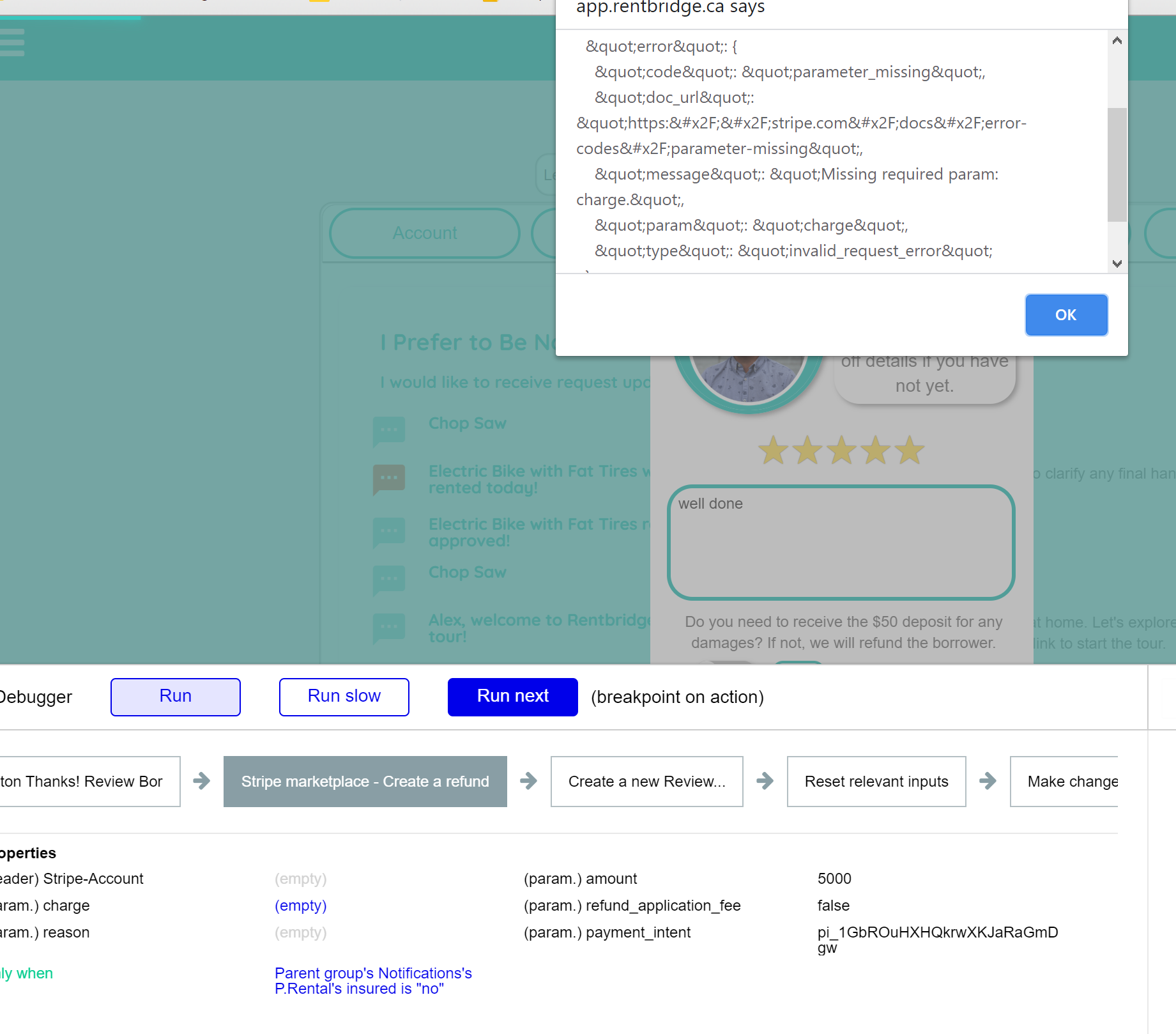

Workflow error - The service Stripe marketplace - Capture a charge just returned an error (HTTP 404). Please contact the plugin author directly for feedback. Raw error: { "error": { "message": "Unrecognized request URL (POST: /v1/charges//capture). If you are trying to list objects, remove the trailing slash. If you are trying to retrieve an object, make sure you passed a valid (non-empty) identifier in your code. Please see Stripe Documentation or we can help at https://support.stripe.com/.", "type": "invalid_request_error" } }

Does this mean I need to fill in the amount section? I thought leaving it blank just let it use the initial amount requested. Or does it mean something else? This was in a test environment. It has worked successfully once in a live environment now.