Apple Pay and Google Pay are transforming how people pay, with faster, more secure options that users trust. Adding these features to your app doesn’t have to be a challenge, and it can elevate the experience for everyone. And, you don’t need to start from scratch to implement them. This tool will help you meet the expectations of today’s digital customers without overwhelming complexity.

1. Giving users multiple Options

Offering both Apple Pay and Google Pay for mobile and desktop can get tricky, especially when trying to create a cohesive experience without diving into multiple APIs.

Solution:

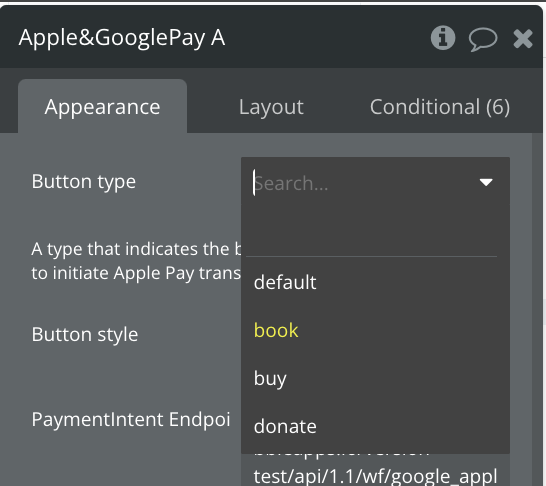

You can configure payment buttons with options like “Button Type” (for checkout or bookings) and style them for consistency across devices. By doing so, users can easily choose their preferred payment method without hassle.

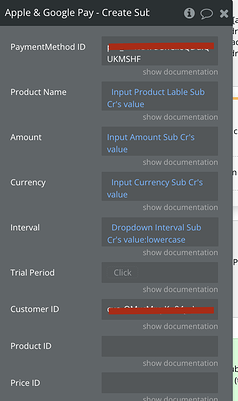

2. Subscriptions

Recurring payments can quickly get messy—setting up billing cycles, handling updates, and dealing with cancellations all take time and effort.

Solution:

You can set up subscription workflows directly using fields like “Create Subscription.” This takes care of renewals and cancellations automatically, and of course saves you a lot of time.

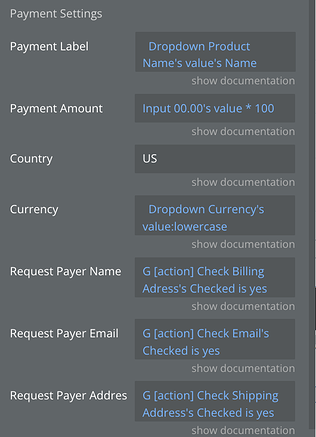

3. Adapting to Global Payment Needs

Supporting different currencies and regions is a must for global users, but it often means constant adjustments in your payment system.

Solution:

With dynamic inputs, you can adjust the “Currency” setting based on user preferences, ensuring accurate payments no matter where they’re located. It’s a small tweak that makes a big difference in keeping payments user-friendly.

4. Capturing the Right User Details

Getting information like names, emails, and shipping addresses can slow down the checkout process if done incorrectly.

Solution:

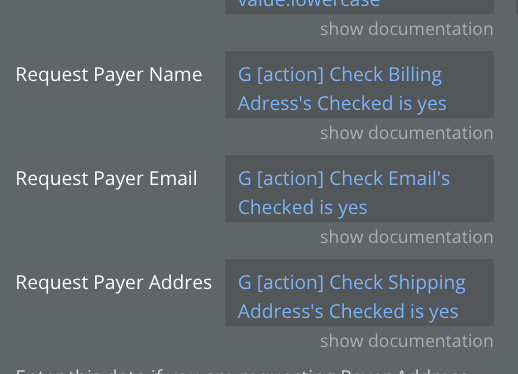

You can toggle options like “Request Payer Name” or “Request Payer Address” depending on what’s necessary for your app. This way, you gather just the right amount of information without making the process feel overwhelming.

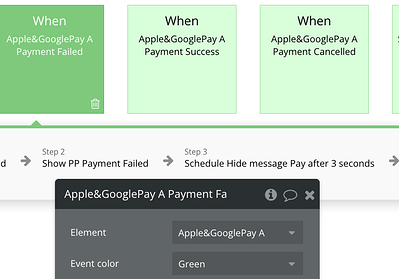

5. Keeping Track of Payments

Knowing when payments succeed, fail, or get canceled can be hard to monitor without a clear system in place.

Solution:

Using built-in events such as “Payment Success” or “Payment Failed,” you can create workflows to notify users or update their orders in real-time. It’s a straightforward way to stay on top of transactions and provide immediate feedback.

Don’t forget, though, that there are some countries where Apple Pay and Google Pay are not yet supported. You can check the list of countries supported by Apple Pay here and Google Pay’s supported countries here.

Happy Bubbling!