I am struggling with this error:

.I create a customer with the work flow, but then when I go to process the payment it says the Customer_ID is not related to the Card_ID.

This is my flow.

Thank you,

James

I am struggling with this error:

.I create a customer with the work flow, but then when I go to process the payment it says the Customer_ID is not related to the Card_ID.

This is my flow.

Thank you,

James

Thanks @alex.grimacovschi made those updates (overlooked some obvious steps) and so far everything’s working as expected!

@alex.grimacovschi, We’re attempting to create a transaction workflow similar to Stripe’s platform example (i.e. Lyft) where we (the platform) charge the customer and payment is disbursed to the seller at a later date. Is it required that we to create a customer and link to a seller if we just want to charge customer directly?

Hello @john1, thank you for reaching out.

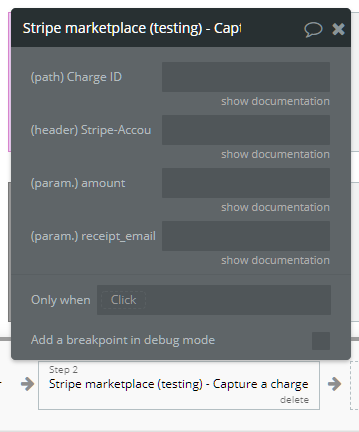

For your use case, we recommend using the action “Seller charge a customer” with capture set to false and source token obtained from “Link a customer to a seller” action.

Then in a different workflow, you can use the action “Capture a charge” to pause the transaction and make the payment when you want. Please consider that by using this logic you will be able to pause the payment for up to 7 days.

Please let me know if that solution works for you.

Best Regards,

Alex

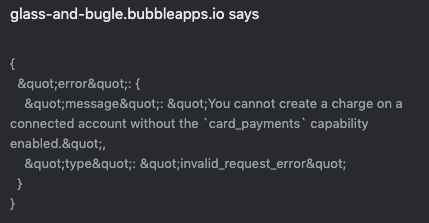

Thanks for the response. We tried the above approach and get the following error:

Here is our configuration:

We confirmed that the seller has the card_payments capability enabled. We can successfully charge the seller if we use Platform charge a customer action.

The Stripe logs show the customer and tokens API calls are successful. Any ideas what’s going on?

Hello @john1 ,

Please check if you are using the ID of the account that has enabled card_payments capability. There may be the case when you enabled card payments to a different account and this is causing the error.

Best Regards,

Alex

We’ve confirmed that the SellerID is correct which is why we’re left scratching our heads. Any other suggestions?

Thanks!

Ben

Strange, maybe you can try to check the ID by looking in the step by step mode. There could be an issue with the data that is called and not the right ID is assigned.

Regards,

Alex

We’ve used step by step mode to verify the ID and even put in a “Send email” activity which emailed the ID to us before and after the flow failed. What’s interesting is that the app errors-out on the “Create a customer” activity.

What else could we try?

@ben2, could you add support@zeroqode.com as collaborators to your app and let us know the name of your app and on which page the problem appear. With access, our team will be able to check directly the problem.

Best Regards,

Alex

Thanks @alex.grimacovschi. Support@zeroqode.com is now a collaborator, and I’ve sent an email to the address with the requested information.

Thanks for all the help!

Ben

Hello @ben2, we got the access and all the information, thank you. We will investigate with our developers what may cause the issue. Once we have an answer I will let you know.

Best Regards,

Alex

While we’re waiting to hear back from support, I have what might be considered a pretty basic question regarding Stripe customers and the related Marketplace Express plugin activities.

We anticipate having two types of customers - those that save a credit card for 1-click purchasing and those that do not. How do we handle customers (and their associated CustomerID) that choose not save a credit card? We create a customer when a StripeMarketplaceToken is created and save the CustomerID to the user.

However, when we using the Platform Charge customer with the saved CustomerID with CardID from the token, Stripe returns the following errors.

Is there a way to use a Customer’s ID with a credit card not associated or saved to Stripe?

Thanks!

Ben

Hello @ben2,

For the cases when you don’t want to save the card you can use the user’s token in the field payment source, without saving the token in the database. Basically, you don’t have to use the action “create a customer” if you don’t want to save data in the database.

The last issue can appear only if you use a source that isn’t related to any customer. We tested and on our side, this error doesn’t appear. Please make sure that when you create a customer in the field payment source you insert the token and as next action add “make changes” and use it to save Customer ID and Source.

Regarding the issue related to “seller charge a customer”, we checked and the only case when this issue can appear is when the IDs are not right. Or the provided ID is related to and account that doesn’t have payment capability.

Best Regards,

Alex

hey all, important update,

Now our plugin is 3D secure ready. "Strong Customer Authentication (SCA), a rule in effect as of September 14, 2019, as part of PSD2 regulation in Europe, requires changes to how your European customers authenticate online payments. Card payments require a different user experience, namely 3D Secure, in order to meet SCA requirements. Transactions that don’t follow the new authentication guidelines may be declined by your customers’ banks.”

We added a second element called SCA that can process payment calls using the 3D Secure flow.

Hi @alex.grimacovschi, I’m having issues with an error and cannot figure out what I’m doing wrong.

Here is my setup. Why would I be receiving this?

Now I’m getting this error. What does this mean?

Your prompt assistance would be greatly appreciated!

Hi I actually answered my own question.

It’s because some of my numbers had a decimal, which doesn’t work with cents, so I simply formatted as a number with zero decimals, which rounds it up and it worked.

Re the header error, I just made sure to get the seller ID set properly.

@alex.grimacovschi @zeroqode I’m hoping to get some assistance.

Is there a way that we can set payouts from the balances of connected accounts to be something other than daily rolling payments? For instance, in my marketplace I want to avoid the chances that a merchant gets paid first, and then goes out of business before delivering on a voucher sold to a customer. This is a very real concern, especially with Covid and the uncertainty of small businesses.

Is there a way through the plugin to delay the payouts from connected accounts and set it to a custom timeframe? Even having the option for weekly, bi-weekly, or monthly would be better than the default daily.

Can you please advise.

Hi @mark2,

Let me jump in here to provide some insights. So, it is possible to hold the transaction on a pause by using the Capture a charge action, for instance. When the seller charges a customer, there is a field called Capture now which can be set to ‘true’ or ‘false’:

By capturing, it can be handy because it will actually charge the customer, first. But it will not transfer the money to the recipient, because it holds on a pause.

Alternatively, there might be a different workaround to this use case, but let me check on it with our development team and I’ll notify you back asap.

Best,

Alex

Hi @alexandru thanks for the reply here.

My impression was that Capture Now set to false simply authorizes the charge, but doesn’t charge it. So you could potentially have scammers with bogus cards picking up products and when it goes to charge it up to 7 days later it doesn’t go through, which can present a whole different set of problems.

My interest is in capturing the charge now, but when the funds are sitting in the merchant account, to not allow the merchant to be able to access the balance until a delayed payout schedule is automatically triggered (bi-weekly, monthly, etc). This would be much more protective of all parties.